The AI Infrastructure Arms Race: OpenAI's Strategy to Challenge Google

Discover the latest in AI infrastructure, investment trends, and tech innovations.

In this issue, we delve into the evolving landscape of AI infrastructure where OpenAI, Google, and Microsoft push boundaries with their data center strategies. We also examine how AI transforms tech investments, making it easier for startups to emerge while posing new challenges for investors. From fintech disruptions to Federal Reserve rate cut speculations, we cover the vital updates you need to stay informed.

OpenAI's data center strategy to outpace Google

AI's influence on tech startups and investment trends

Potential Federal Reserve rate cuts and their implications

Telegram's security concerns and Pavel Durov's arrest

Rising fintech regulatory scrutiny and CFSB's partnerships

Long-context LLMs versus Retrieval Augmented Generation (RAG)

Evolution of open-source AI: data, legality, and reproducibility

"Intel's missed opportunities in the smartphone chip market

Let's dive deeper into these fascinating topics, starting with the high-stakes AI infrastructure race reshaping the tech landscape.

A Newsletter for Visionaries, Innovators, and Leaders. For more information, visit our website: https://thirdspace.ventures

📰 Feature Articles

The AI Infrastructure Arms Race: OpenAI's Multi-Datacenter Strategy to Overtake Google

AI infrastructure giants like OpenAI, Microsoft, and Google are in a heated race to build ultra-dense, multi-datacenter campuses to train next-generation AI models. Google leads with an advanced multi-gigawatt, liquid-cooled data center network, but OpenAI and Microsoft are betting on massive, interconnected, gigawatt-scale clusters across multiple regions. Using synchronous and asynchronous distributed training methods, these companies are overcoming the physical limitations of single-site model training, pushing the boundaries of infrastructure, telecom networks, and fault-tolerant systems. (SemiAnalysis)

AI's Radical Impact on Tech Investing: Fewer Startups, Fiercer Competition

AI is fundamentally reshaping tech investing by lowering barriers to entry, making it easier and cheaper to launch new startups. This new era enables individual solopreneurs to thrive, often without the need for venture capital, leading to heightened competition. As a result, many traditional tech businesses face disruption while AI-driven startups emerge rapidly. Investors are encountering new challenges as fewer companies need capital, startup survival rates decline, and public markets are locked out of these AI-fueled ventures, altering the entire investment landscape. (Uncharted Territories)

Unlock Your Trading Potential with TradingView

Elevate your trading strategy with TradingView! Access cutting-edge charting tools, real-time market data, and a vibrant trading community. Join millions of traders who trust TradingView for their market insights.

The fastest way to follow markets is TradingView.

🗞️ In Other News

Long-context LLMs won't replace Retrieval Augmented Generation (RAG), as RAG remains crucial for handling various AI challenges. (TheSequence)

Pavel Durov's arrest centers on law enforcement resistance and Telegram's security risks, not free speech. (Read Max)

CFSB's aggressive fintech partnerships have increased regulatory scrutiny and legal challenges. (Fintech Business Weekly)

OpenAI's next funding round is set to accelerate consolidation, making competition harder and further solidifying BigTech's dominance. (AI Supremacy)

AI inference is becoming faster, cheaper, and more efficient, potentially 3000x quicker than six years ago. (Latent Space)

Intel's missed opportunity with the iPhone stemmed from strategic missteps, lousy timing, and poor decisions in the smartphone chip market. (The Chip Letter)

Natural Language Processing (NLP) enables AI systems to understand and process human language, powering applications like chatbots. (Artificial Corner)

The current definition of open-source AI is evolving, focusing on balancing data accessibility, legal concerns, and reproducibility. (Interconnects)

Airbnb's Brian Chesky sparked a "Founder Mode" movement, promoting hands-on leadership and innovation. (Sourcery)

The next phase of crypto will see the most value shift from blockchains to DeFi applications as blockspace becomes commoditized. (DeFi Education)

Stay in Your Cybersecurity Bubble with NordVPN

Protect your online privacy and enjoy unbeatable savings! Get up to 74% off on 2-year plans, plus three extra months free.

Starting at just $3.09/month (down from $11.59), NordVPN is the perfect way to secure your digital life. Stay safe while browsing, streaming, and traveling with one of the most trusted VPN services.

Get NordVPN now and keep your cybersecurity bubble intact.

📈 Market Updates

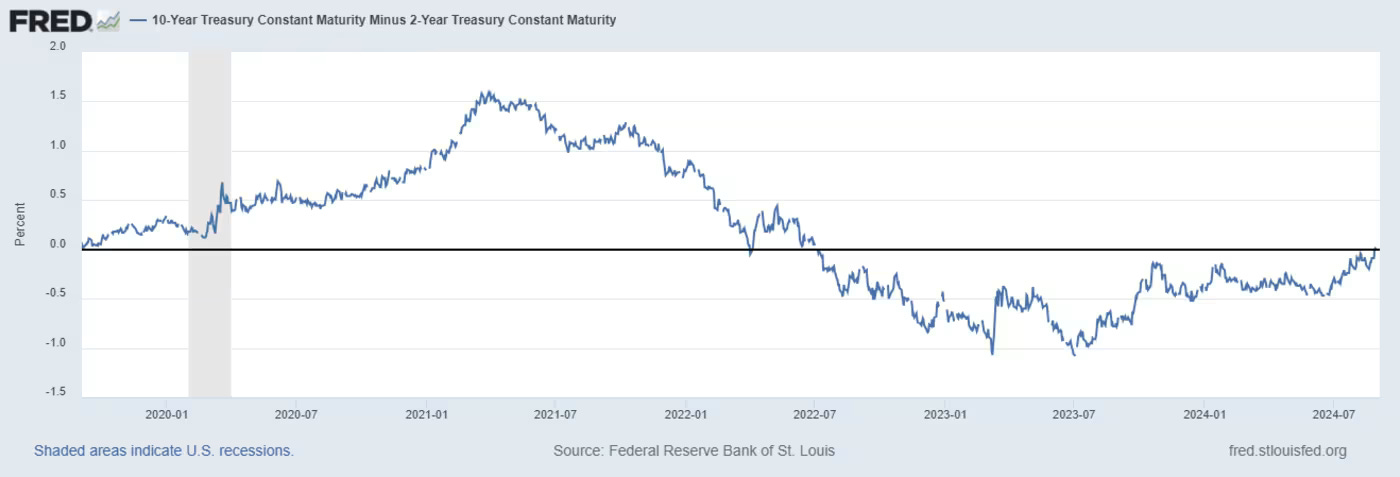

Investors anticipate a potential 50-basis-point rate cut by the Federal Reserve in September. While lower rates might seem appealing, experts warn that a larger rate cut could signal deeper economic concerns, particularly about recession risks. Morningstar’s David Sekera notes this could trigger further stock sell-offs, as it might suggest the Fed is more focused on recession than inflation. Citi's Andrew Hollenhorst also highlights growing labor market weakness, suggesting the economy’s “Goldilocks” moment could be fleeting. (Yahoo! Finance)

The U.S. Treasury yield curve is nearing a critical shift as the 2-year yield is close to falling below the 10-year yield for the first time since 2022, signaling a potential recession. Historically, the un-inversion of this curve, after a prolonged inversion, has been a reliable recession indicator. Investors are also closely watching Friday’s unemployment report to assess economic strength. While some experts, like Guy LeBas from Janney Montgomery Scott, believe a recession may still be avoided, the aggressive pricing of rate cuts suggests heightened concerns about economic downturns. Markets remain volatile, with mixed stock performance following previous un-inversions. (Market Watch)

Analysts expect the Federal Reserve to stick with a quarter-point rate cut in September as employers continue hiring slower and unemployment rises to 4.3%. Fed policymakers, including Atlanta Fed President Raphael Bostic, emphasize careful consideration of upcoming jobs and inflation data before making a final decision. (One America News)

European shares remained flat on Thursday as gains in utilities were offset by losses in the mining sector. The pan-European STOXX 600 index saw little movement, with miners declining due to weakened global demand, particularly in China. Utilities and real estate stocks rose, buoyed by weaker U.S. economic data that increased expectations of potential Federal Reserve rate cuts. German industrial orders rose unexpectedly by 2.9%, slightly boosting the DAX index. Investors await eurozone retail sales and U.S. labor market data, with Friday's nonfarm payrolls report as a key market indicator. (Reuters)

😎 Good Reads and Writers

Financial Freedom is not free, but the treasure is worth the pursuit! Learn to manage your own wealth. Substack Featured 3x. (Not Your Advisor x NYUGrad)

Market beating stocks in 5 min. Picked by elite traders, delivered weekly to your inbox pre-market. (Money Machine Newsletter)

Weekly analysis of QQQ and financial charts. This is not investment advice, always do your own due diligence. (QQQ notes)

📘 Useful Tools and Resources

Equip your business for success with Acer's essential laptops, desktops, monitors, and accessories. (Acer)

Dose for Excel enhances your Excel with over 100 new features and functions to boost productivity. (Dose for Excel)

Remixable automates all the key steps to running a successful Internet business. (Remixable)

Sqribble is the all-in-one fast & easy solution for Ebooks. (Sqribble)

🎉 Speakers and Events

FinovateFall New York September 9 - 11, 2024 (Finovate)

The ET Soonicorns Summit Bengaluru September 20, 2024 (Economic Times)

TradersEXPO Orlando October 17 - 19, 2024 (MoneyShow)

AI AI Boston October 16 - 18, 2024 (AI Accelerator Institute)

✅ Interactive Poll

📢 Advertise with us

Elevate your brand's visibility by partnering with ThirdSpace Buzz. Our newsletter reaches professionals in various industries. Position your message directly in front of industry leaders and decision-makers.

🤟 Closing Remarks

Thanks for joining us this week! Don't miss our next issue.

💬 Feedback and Social Sharing

We value your thoughts! Please share your feedback and follow us for more updates.

With a possible Federal Reserve rate cut of 50 basis points, investors brace for potential economic shifts. Will this signal deeper recession concerns?